News & Insight

How data and the pursuit of customer lifetime value (CLV) will transform sports media rights over the next decade and drive new value for rightsholders.

In 2024, the global value of sports media rights will surpass USD $60 billion[1]. However, uncertainty in the decade ahead is arguably the sector’s most debated, and determinative topic.

The global value of sports media rights grew at a compound annual growth rate (CAGR) of 1% between 2018-2023[1]. During the same time period, global media and entertainment revenue grew at 5% CAGR[2], global gaming revenue grew at 15% CAGR[3] and global digital advertising revenue grew at 16% CAGR[4].

Changing economic conditions in the industry during the decade ahead will present sports’ biggest challenge but also its greatest opportunity.

A media rights transaction can solely determine the short, medium, and long-term growth trajectory of a rightsholder, and the extent to which it can support key stakeholders such as fans, clubs, constituent federations, athletes, grass roots organisations and, increasingly, private equity (PE). With the latter’s now frequent involvement in rightsholders’ capital structuring and corporate governance, forecasted media rights revenues (typically using optimistic scenarios at valuation point) are a critical bridge to achieving performance targets across the investment horizon.

As cost of capital increases, it is even more important that investment theses in professional sports (and discount factors used in any valuation analysis) are compiled from a clear understanding of the risk and opportunity ahead for, traditionally, the sector’s largest revenue source.

However, with continual changes in consumption behaviour and enabling technology, rightsholders are subject to unprecedented complexity when forging their media rights strategies and, importantly, bringing their stakeholders with them on this journey. The destination, however, can be transformative. In our new report we distil this complexity and provide a list of strategy guardrails to drive media rights value growth over the next decade.

Ask any pilot and they will tell you that a headwind is favorable at takeoff because an airfoil moving into a headwind generates lift. The changing economics of the media and entertainment industry have created headwinds that sports are uniquely positioned to harness.

By grounding their strategies in these economic trends and what they mean for potential licensees, rightsholders can accelerate growth in the value of their media rights. The trends, now well established and commonly reported, can be consolidated into four interdependent drivers (see Figure 1). Their combined effect, detailed in the report, is a reduction in economic profit available to media and entertainment companies (i.e. what’s left over after subtracting the cost of capital (or opportunity cost) from net operating profit). Under these conditions, customer retention, and the customer lifetime value (CLV) it helps generate, becomes pivotal. Media and entertainment companies are therefore increasing their focus on the accurate measurement of CLV and the content and marketing strategies to build it.

Figure 1 | The Increased Importance of Customer Lifetime Value (CLV)

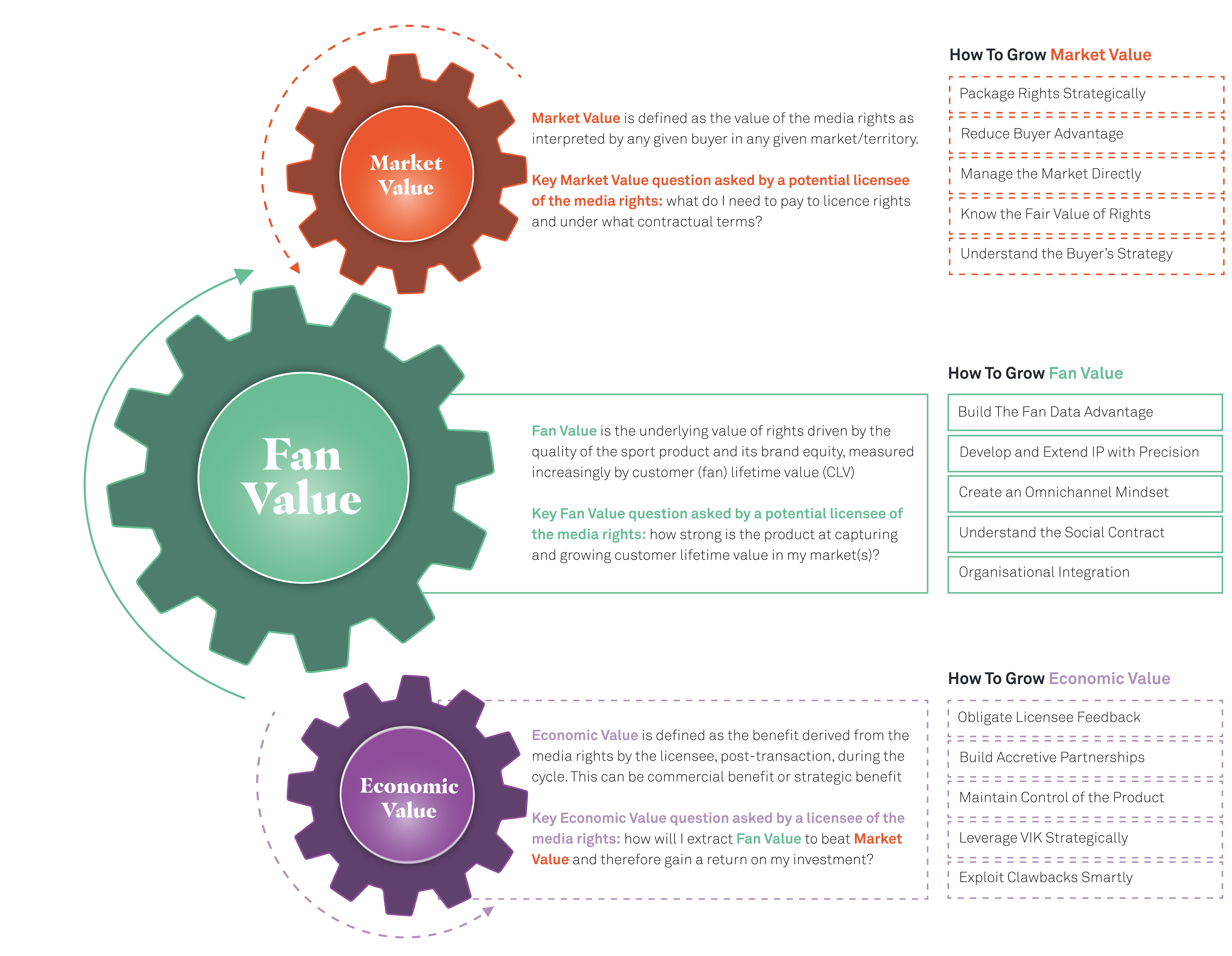

Growth in the value of sports media rights occurs via a flywheel consisting of three connected components: Fan Value, Market Value and Economic Value. These are represented below (Figure 2) by connected cogs of different sizes, the size depicting the relative influence on the speed of the overall flywheel of each value type.

Figure 2 | The Media Rights Flywheel

Turning this flywheel requires strategic alignment and data integration between each of the three value types. Although growing each of the value types has always been, and continues to be, essential in achieving cycle-on-cycle media rights value growth for rightsholders, in the past the relative sizes of the three wheels (representing their relative influence on turning this flywheel) were very different.

Market Value would have previously been the largest cog, with market competition, dynamics and concentration in any given territory and/or region having a proportionately greater influence on the growth rate of media rights value than either Fan Value or Economic Value. The result of this was the popularity amongst rightsholders of shorter rights cycles where permitted, allowing the capture of sequential uplifts in the value of rights.

However, current market conditions, created by the four economic drivers above, have switched Fan Value and the CLV it generates to be the key determinant of growth – leading, in turn, to extended rights cycles and territorial coverage being frequently the preference of both rightsholders and licensees. In the report we provide 15 strategy recommendations to grow all three value types and accelerate the flywheel.

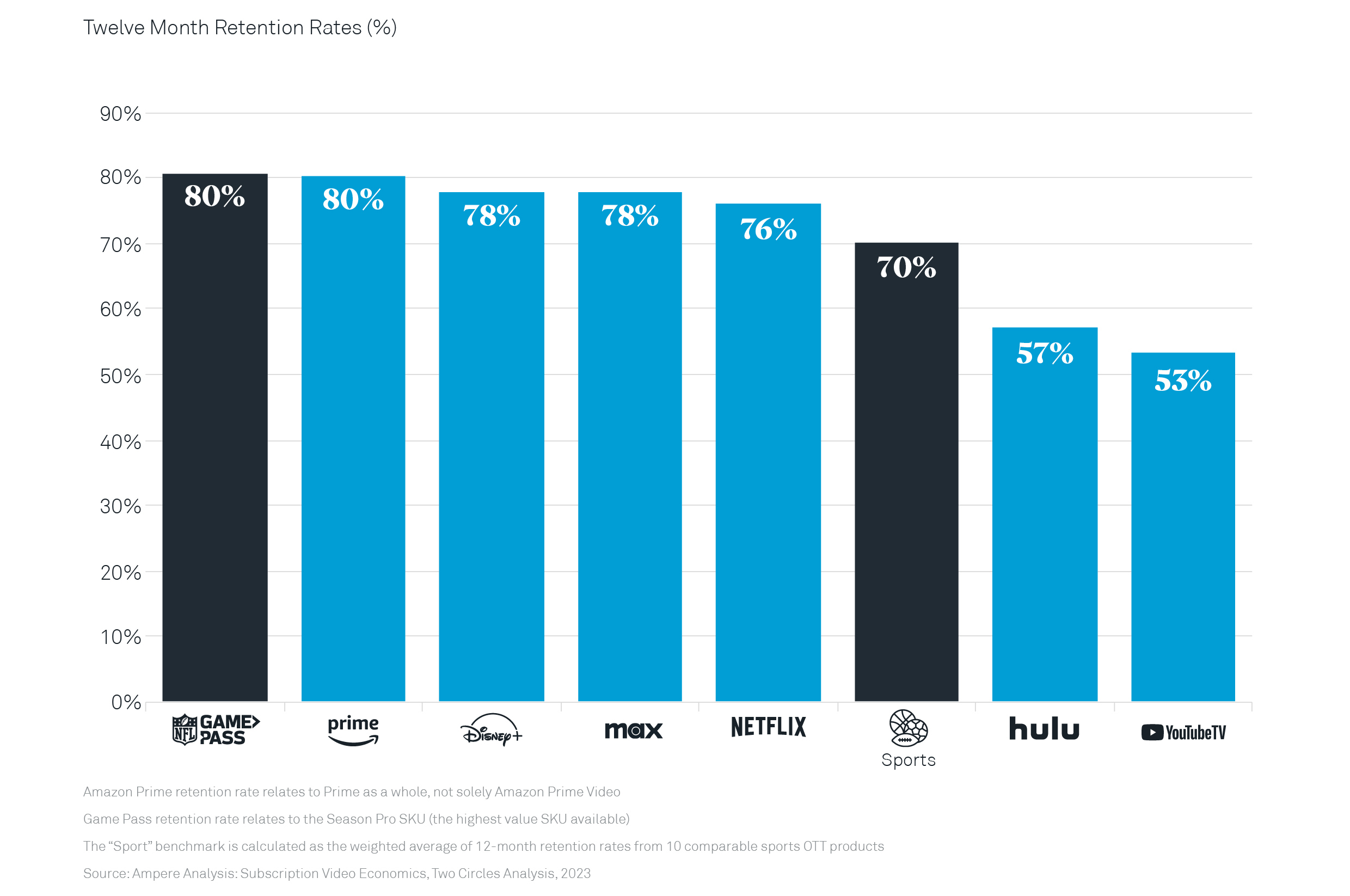

For the last six years, the global partnership between the NFL and Two Circles provided an end-to-end marketing solution for Game Pass International (GPI) across 181 territories. Powered by a cross-functional obsession with audience insight, GPI hit aggressive subscriber growth targets by strategically focusing on Fan Value and prioritizing CLV across data, marketing, content, commercial and proposition workstreams. The result was 80% annual subscriber retention by 2023 (Figure 3).

Figure 3 | GPI’s Market Leading Customer Retention

Every evolutionary step taken by GPI was designed to develop Fan Value, creating a value exchange that NFL fans across the world would come to, and return for, season after season. From dynamic behavioral segmentation and propensity modelling, to continual testing of price elasticity, fan sentiment, promotions and content, and deep personalisation of the user experience, GPI became the leading source of NFL’s new international first-party data records over the six-year period[5] (outside of North America and China).

The successful sale to DAZN of GPI early in 2023 demonstrated the efficacy of this approach and the new primacy of Fan Value and CLV in driving the value of sports media rights.

While the economic headwinds in the media and entertainment industry will continue to strengthen over the decade ahead, sports, as a multi-faceted content genre, has the ability to harness them.

GET IN Touch