News & Insight

‘Big Games’ strategy driving women’s football attendances, underlines structural and commercial growth potential for clubs and leagues across Europe:

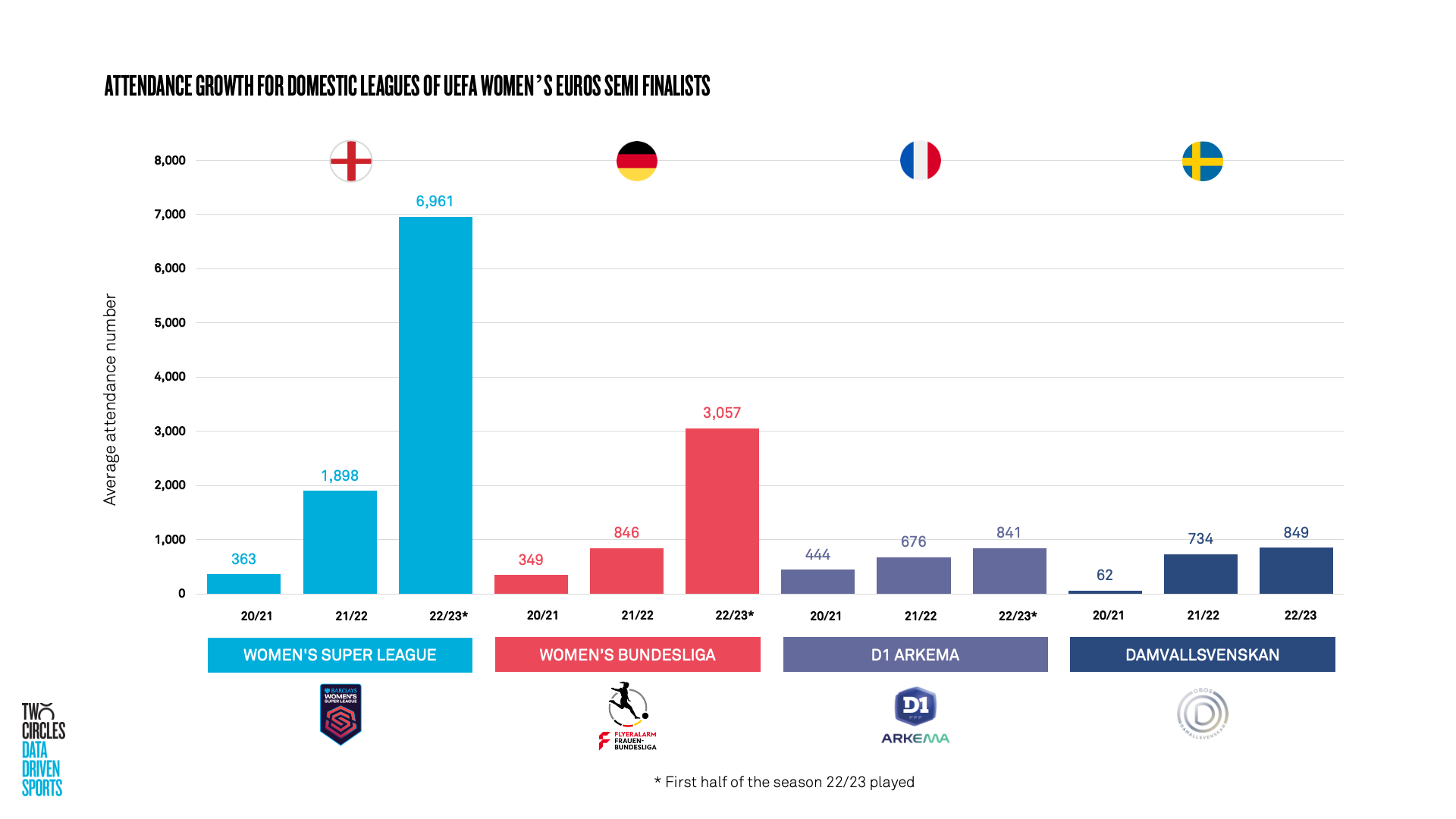

- Increase in attendance for Women’s EURO 2022 semi-finalists up an average 182% compared to 2021/22 season

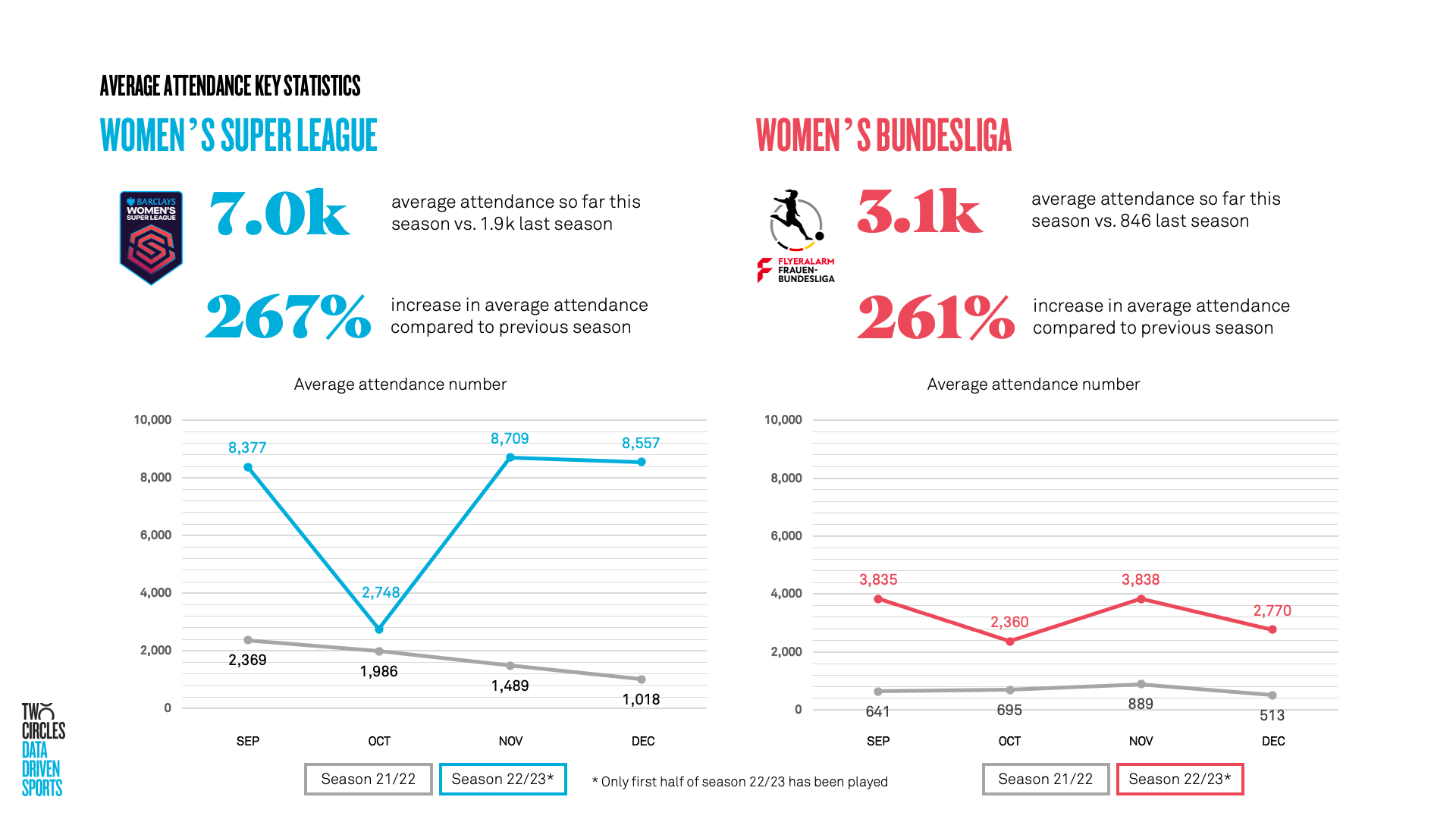

- Significant increase in attendance for the English Women’s Super League (+267%) and the German Women’s Bundesliga (+261%) through first part of 2022/23 season, driven by ‘Big Games’ strategy

- Success of ‘Big Games’ strategy – access to bigger venues, marketing power, existing club fan bases – linked to increased engagement and strategic investments from top national football clubs

- Growing visibility (above short-term profitability) key factor in driving sustainable growth cycle – and long-term commercial success – for women’s football

It is well documented that 2022 was a year of records for women’s football in Europe. Sporting history was made during the 2022 edition of the UEFA Women’s Champions League, with the global, all-time attendance record broken twice in three weeks.

And after 91,648 spectators flocked to Camp Nou for Barcelona vs. Wolfsburg in April, more records soon tumbled during the summer’s UEFA Women’s EURO 2022 in England. The previous tournament attendance record was surpassed before the knockout rounds even began. Ultimately, 87,192 fans witnessed England’s Lionesses defeat Germany in the final at Wembley Stadium, a single-game tournament record (women’s and men’s), with 574,875 spectators entering through the turnstiles across the tournament.

Now, just a few weeks into 2023, analysis by Two Circles shows that women’s football continues to carry that momentum. In fact, the four nations who reached the semi-finals at the 2022 edition of the UEFA Women’s EURO (England, Germany, France, Sweden) are already boasting record domestic league attendances, up an average 182% from the 2021/22 season.

The FA Women’s Super League surpassed the entire total attendance for the 2021/22 season (250k) in just 40 games – less than a third of the way into the 2022/23 season – and its impressive increase in attendances (+267%) is almost equalled by the German Women’s Bundesliga, which is seeing a 261% increase in attendances since the start of the season. By the seventh Women’s Bundesliga match day of the 2022/23 season, the total attendance from the entire previous season was already surpassed.

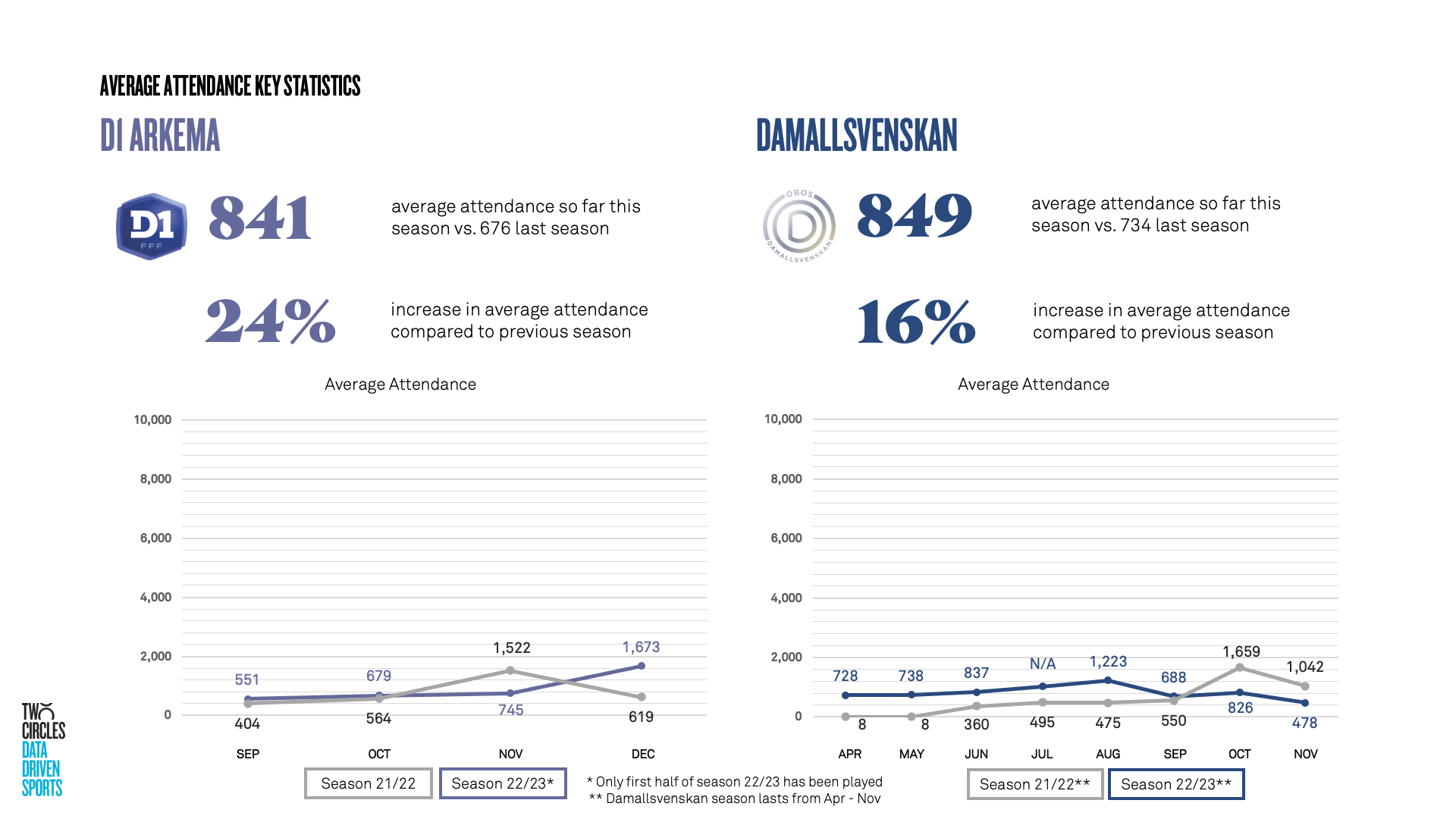

Although at smaller scale, domestic leagues in France and Sweden – the other semi-finalists from last year’s tournament – are also experiencing notable year-on-year growth in attendances of 24% and 16% respectively.

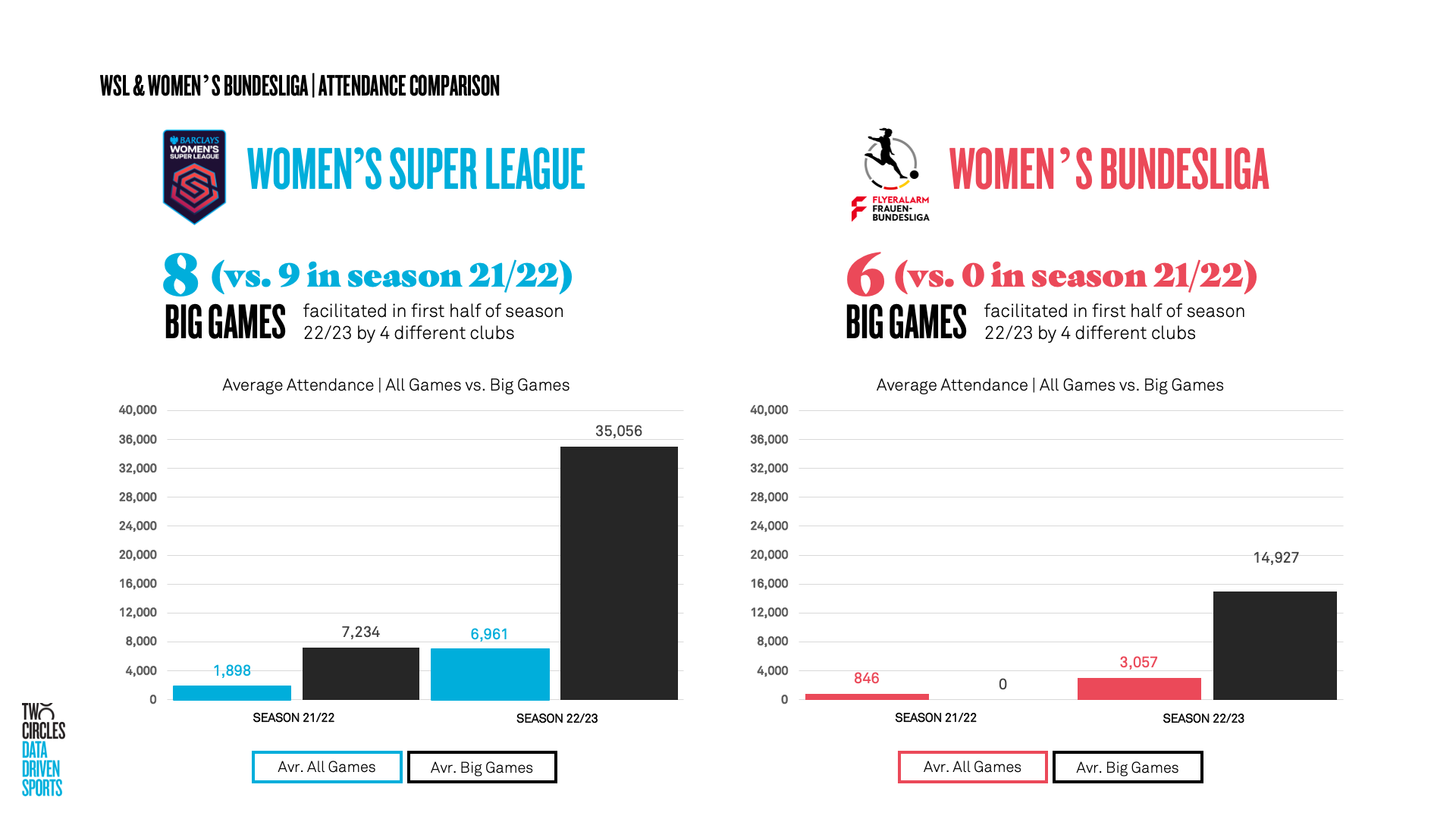

Driving this significant increase in average attendances for the WSL and Women’s Bundesliga since the start of the 2022/23 season: The application of a ‘Big Games’ strategy by a selection of clubs in both England and Germany.

These ‘Big Games’ – one-off matches that take place in stadiums with a capacity of >20K, and are promoted with higher marketing efforts – have led to attendance records being broken in both England (47k) and Germany (23k) since the start of the season.

In the first half of the FA Women’s Super League, 8 ‘Big Games’ took place – just 1 fewer than throughout the entire 2021/22 season. The 2022/23 season’s record attendance 47k, for the Arsenal vs. Tottenham game which took place in September 2022, was 6.8 times the season’s average attendance (7.0k). All 8 ‘Big Games’ facilitated this season have surpassed the record attendance (20,241) established during the 2021/22 season.

The German Women’s Bundesliga has held 6 ‘Big Games’ since the start of the 2022/23 season, whereas during the season 2021/22 no dedicated ‘Big Games’ were organized. 5 out of 6 of these games surpassed the previous historic attendance record (4.5k) established during the 2021/22 season.

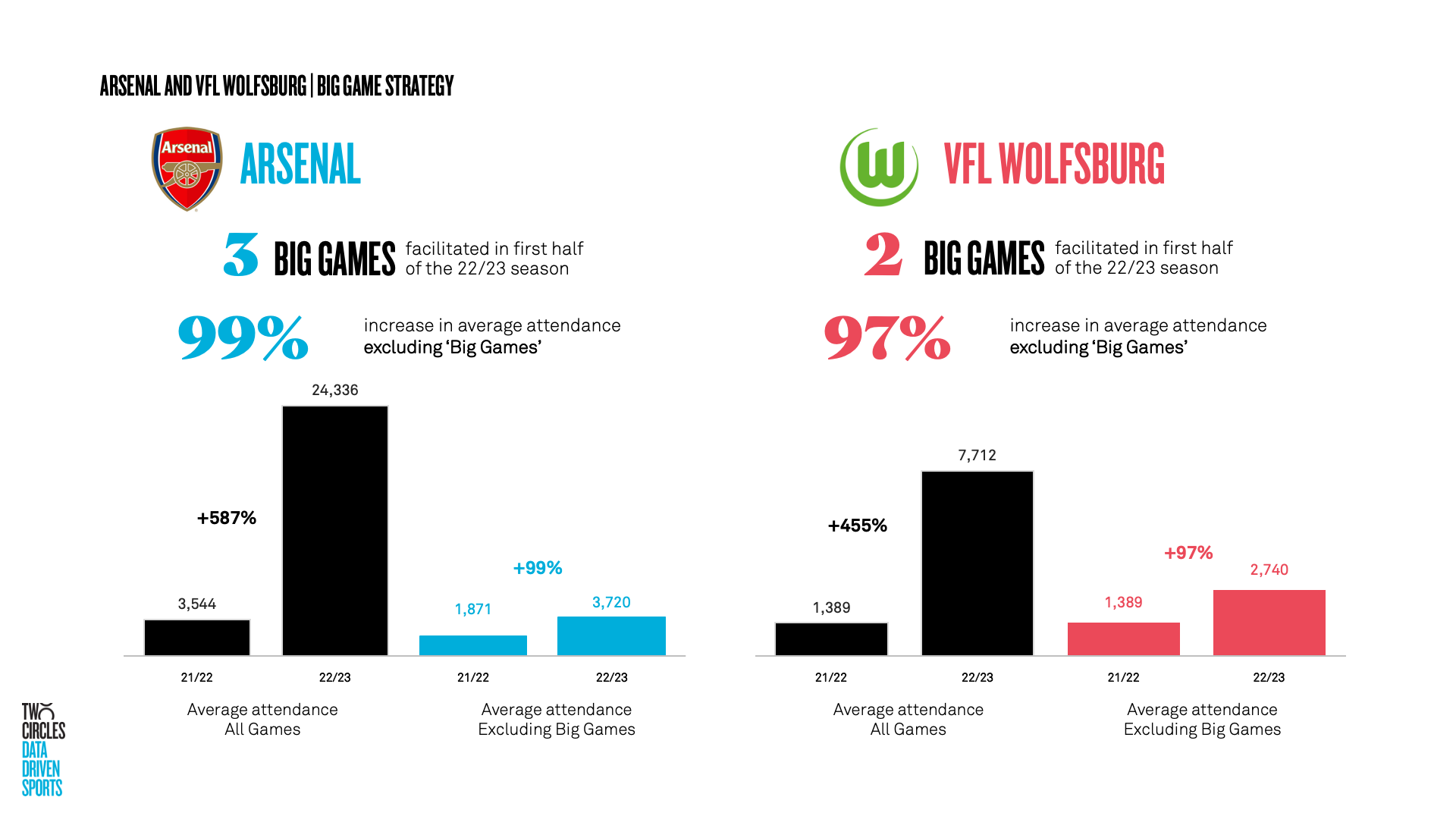

Breaking down the 2022/23 season attendance figures for the FA Women’s Super League and Women’s Bundesliga, it can be noted that these ‘Big Games’ are indeed the leading contributor to the record-breaking overall attendances seen in both leagues this year. However, Two Circles analysis also shows that when these ‘Big Games’ are removed from the equation, both leagues are still seeing considerable, relative, year-on-year growth.

- FA Women’s Super League 2021/22 vs. first part of 2022/23 season: 1,507 to 2,799 (+86%)

- Women’s Bundesliga 2021/22 vs. first part of 2022/23 season: 846 to 1,739 (+106%)

Focusing on 2022/23 attendance leaders in the WSL and Women’s Bundesliga, Arsenal and Wolfsburg – who have both hosted multiple ‘Big Games’ this season – available data on attendances also confirms the potential impact, and associated opportunities, of integrating a ‘Big Game’ strategy at club level.

Market intelligence

Success of ‘Big Games’ strategy, linked to increased engagement and strategic investments from top national football clubs

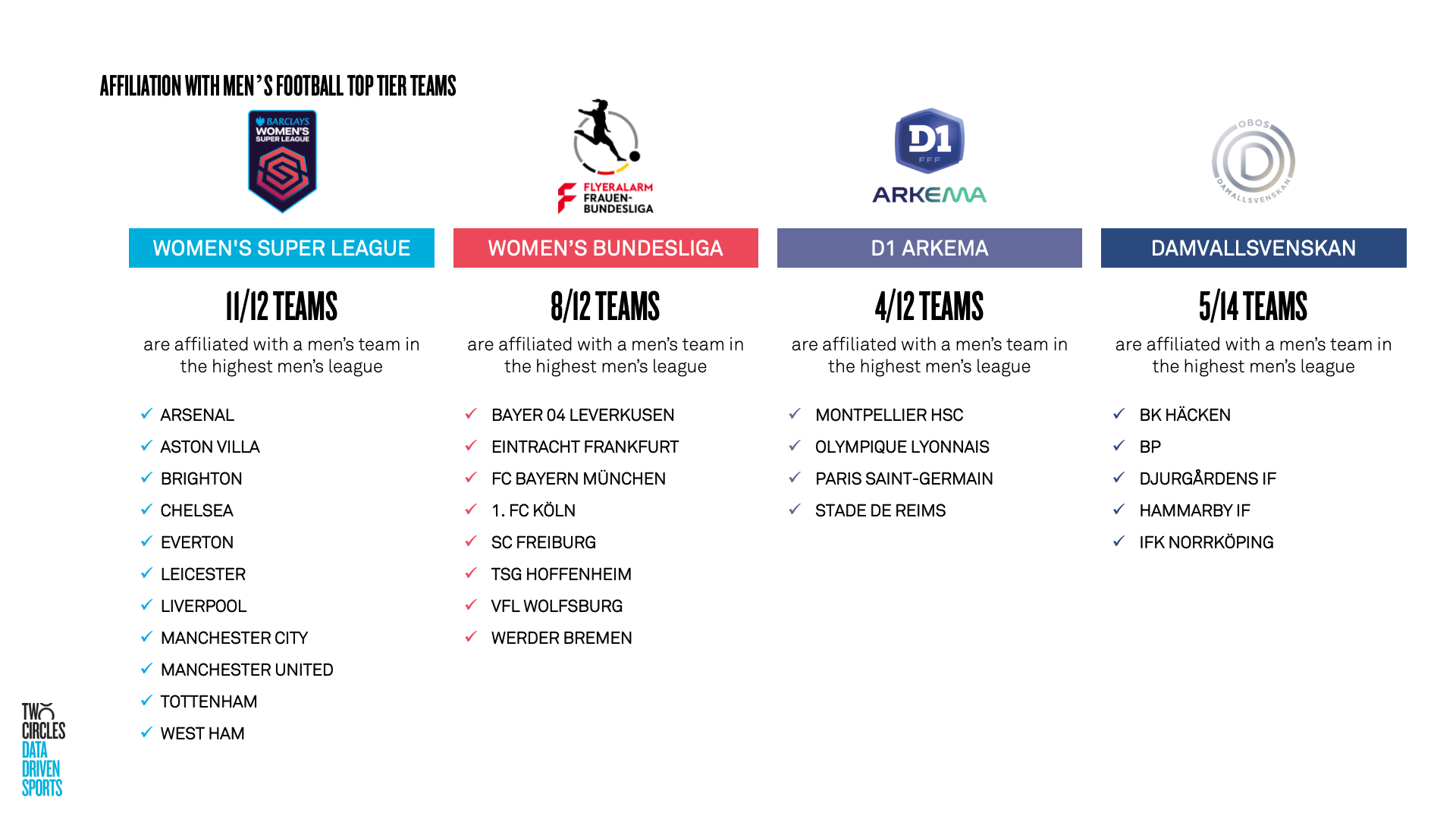

Analysis shows that levels of investments, dedicated resources and professionalization vary greatly between leagues and clubs across Europe. But it also shows that there is today a clear correlation between the number of leading football clubs in a country who have both a men’s and women’s team evolving in the country’s topflight, and the level of structural change occurring for women’s football in the respective country at league and national team level.

As such, if it can be suggested that record attendances for women’s football in England and Germany this season have been driven by this ‘Big Games’ strategy – and spurred by historic runs to the final by both countries’ national teams at last summer’s UEFA Women’s EURO – advancement in structural change across topflight clubs, relative to European counterparts, is a better reflection of the good dynamic behind women’s football attendances in both markets today:

- In England, 11 out of the 12 clubs in the FA WSL are affiliated to a men’s team competing in the Premier League (Arsenal; Aston Villa; Brighton; Chelsea; Everton; Leicester; Liverpool; Manchester City; Manchester United; Tottenham; West Ham)

- In Germany, 8 out of the 12 clubs in the Women’s Bundesliga are affiliated to a men’s team competing in the Bundesliga (Bayer 04 Leverkusen; Eintracht Frankfurt; FC Bayern München; 1. FC Köln; SC Freiburg; TSG Hoffenheim; Vfl Wolfsburg; Werder Bremen)

- In comparison, 4 out of 12 teams in the French D1 Arkema (Montpellier HSC; Olympique Lyonnais; Paris Saint-Germain; Stade de Reims) and 5 out of 14 clubs in Sweden (BK Häcken; BP; Djurgårdens IF; Hammarby IF; IFK Norrköping)

Growing visibility key factor in driving sustainable growth cycle – long-term commercial success – for women’s football

Previous Two Circles’ studies in Germany (Study on the development of the Women’s Bundesliga, in partnership with the German Football Association (DFB)), the UK (Study into the commercial drivers of women’s sport in the UK, in partnership with the Women’s Sport Trust) and France (Study on the development of Women’s Sport in France, in partnership with SPORSORA) have all underlined the importance of growing public awareness in driving a sustainable growth cycle for women’s football.

With visibility identified as a key element of the sustainable growth cycle for women’s football, profitability should not be the leading factor and sole measurement of a club’s and league’s initial investments in its women’s football properties (with most clubs currently facilitating ‘big games’ admitting limited direct returns).

Beyond offering visibility and media attention – participating in the overall growth of the sport – ‘big games’ allow clubs and leagues to develop insights on a highly diversified audience, engaging with significantly different offers from clubs (interest & audience profile for ‘big games’ vs ‘regular games’ etc.).

The premium gameday experience offered to fans through these ‘big games’, also plays a key role in retaining fans and increasing fan affinity. In a big stadium, the players become stars and spectators turn into fans that will return for ‘Big’ or regular games.

However, it is suggested that strategic investments towards growing visibility for Women’s Football (access to bigger venues, increased marketing budgets, engagement of existing club fan bases etc.) need to be supported by the mobilization of the entire national football ecosystem (leagues, clubs, fans, media and sponsors) to enable long-term commercial growth for women’s football.

As such, to drive the sustainable long-term development and success of women’s football in Europe, ambitious strategies and investments focusing on growing visibility, such as the ‘big games’ strategy – need to complement wider efforts towards implementing significant structural change, which support the professionalization of the sport.

Key takeaways on the ‘Big Games’ strategy

Driven by data and enriched by market intelligence from across Europe, Two Circles draws the following conclusions with regards to the ‘Big Games’ strategy:

1. Women’s football has a capacity to attract significantly larger crowds beyond major events such as the UEFA Women’s European Championships, and FIFA World Cup.

2. A strong correlation exists between women’s football attendances and the number of teams within the league affiliated to a men’s team playing in the country’s top flight.

3. Women’s football teams can benefit greatly from access to infrastructure, marketing power and engagement with the existing fan bases of their respective men’s teams.

4. Clubs with established brands and popular stadiums see most success in attracting large crowds.

5. The ‘Big Games’ strategy can play a determining role in driving structural change – a sustainable growth cycle – for women’s football at both league and club level

- a) ‘Big games’ leading to record attendances, create that much needed visibility and media attention for women’s football – participating in the overall growth of the sport

- b) It allows to develop insights on a highly diversified audience, engaging with significantly different offers from clubs

- c) A premium gameday experience plays a key role in retaining fans and increasing fan affinity.

6. Associating a ‘big games’ strategy, to a more holistic and structural approach to growing the sport – across the football ecosystem – is needed to enable long-term commercial success for women’s football

GET IN Touch